While the global stock market, major economic sectors, and world economies take a hit amid strong rumors of a looming economic recession, the crypto market especially Bitcoin has had struggles of its own. The weeks following the opening of 2020 looked all god for Bitcoin as the crypto mounted a bullish move in preparation for the reward halving in May. Generally, the halving has always been a bullish event.

However, the continued negative sentiments as a result of the spread of the CoronaVirus has put a block on Bitcoin’s path to the moon, sending the crypto’s price rolling South to the lows of $5,000 from a previous optimistic high of $10, 500. In a tweet, one technical analyst opined that the price will take a while to get back up. He explained what’s happening.

Market Shock

First off, a sudden price crash like what happed with Bitcoin ends up creating a relatively uncertain environment due to fears of the unknown. This can be summed up as some kind of Post Traumatic Stress Disorder (PTSD) that is now keeping the market under pressure and scaring away buyers and new investors that would otherwise fuel a buy pressure and push the price back up.

That’s not what happening right now, and it could explain why Bitcoin’s price keeps swinging up and down within a short-range. Basically, the market is still uncertain about which direction to take.

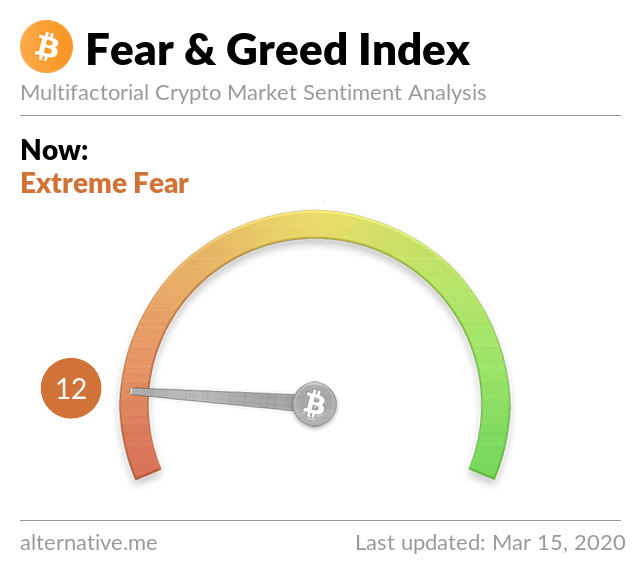

A look at the Fear and Greed Index indicates that, currently, the market sentiment is at the extreme fear region, meaning that people are backing away from Bitcoin.

It’s About The People

Going on, the analyst argued that Bitcoin’s price movement is actually fueled by the people themselves. Whenever there’s a positive sentiment, FOMO takes over the price spikes as more money flows in due to increased buy pressure. However, the current atmosphere is that of diminished positive sentiment.

However, some analysts have argued that this is just a passing cloud that should be over soon, in which case Bitcoin’s price will recover and retrace its bullish trajectory.