Having failed spectacularly the first time around, controversial “experimental” DeFi project YAM is preparing to launch Version 3 on Friday, September 18.

After a month of interim governance and auditing, YAM is set to relaunch on Friday, September 18.

Please see here for full information: https://t.co/1Mra5biT59

You can view the audit here:https://t.co/VhITXIBIN3

— Yam Finance (@YamFinance) September 14, 2020

Those in the crypto community will be well aware of the disaster that was YAM Version 1. In short, it exploded onto the scene, peaking at a $650 million market cap. But the discovery of a bug in its rebasing contract crashed the price in less than two days.

With that, YAM founder Brock Elmore tweeted his regret at having failed.

Source: twitter.com

While some extended their support, others, such as crypto entrepreneur Bruce Fenton did not hold back in criticizing YAM, as well as the DeFi space in general.

“Your #DeFi tokens are junk. They are not a good form of money. You have no ownership of an enterprise. No rights to revenue. There is no real revenue. Governance is meaningless without rights. Total crap – often pushed by the same jokers who got rich on ICOs. Few understand this.”

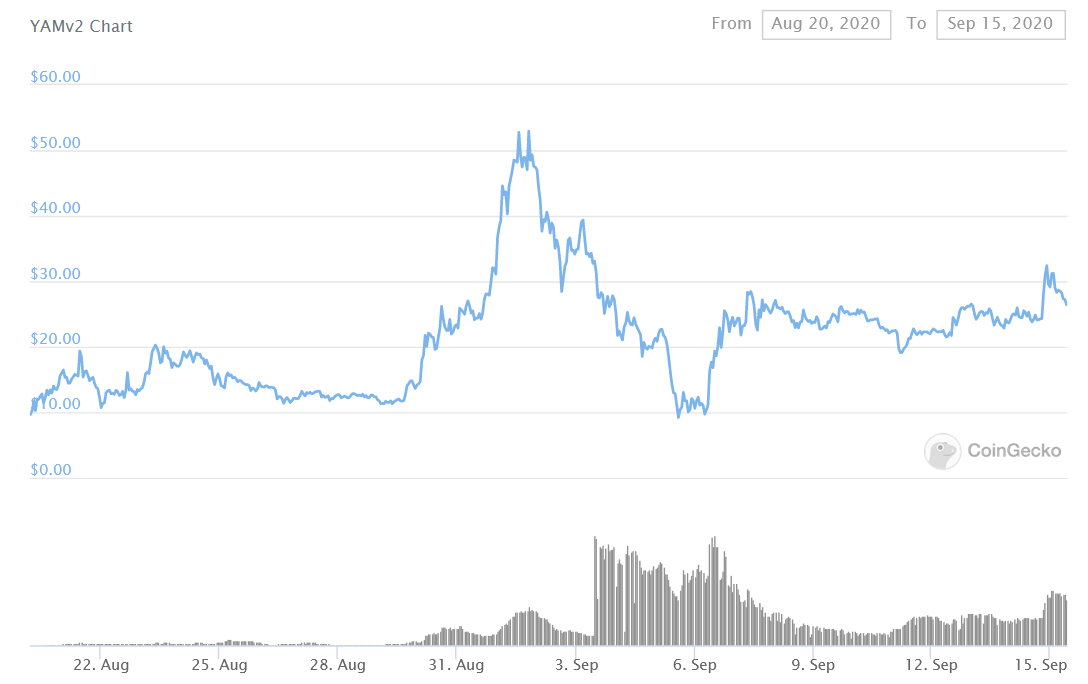

Nonetheless, ever since YAM went to zero, the team has openly talked about relaunching, which they did with Version 2 on August 20th.

But considering the reputation of food-themed DeFi projects, especially one that has already failed, community sentiment is cautious.

YAM Gets Green Light For Version 3 Launch

The YAM migration will take place in stages, or versions. Version 2 refers to an interim stage that migrates YAM contracts noting previous balances without taking into account rebasing data.

This process acted as a placeholder while the Version 3 code was audited. Blockchain security firm Peckshield was responsible for the audit.

YAM Version 1 holders can burn their tokens to mint Version 2 tokens. In turn, holders then convert Version 2 tokens into Version 3 tokens.

According to a blog post by the YAM team, the migration process went off without a hitch. This includes Peckshield signing off the code.

“The replanting of YAMs comes after an active and thoughtful interim governance period, during which the community came to consensus on all key issues for V3’s launch, as well as after a successful audit by PeckShield.”

The report by Peckshield noted a number of high and medium severity code flaws, but none that were critical. They noted items such as inaccurate vested percentage calculator in migrator, and explicit wrappers for YAM conversions. However, Peckshield commented that all identified issues were corrected.

Once Bitten Twice Shy

All the same, despite Peckshield’s involvement, it’s important to note that audits do not guarantee bulletproof code.

As well as that, what happened with YAM still divides opinion. On the one hand, some believe it was an exciting experiment that delved into the effects of protocol rules on price.

Whereas others, including MyCrypto CEO, Taylor Monahan, were taken aback by the rapid pace at which an unaudited project took off.

“but no one imagined an openly unaudited project with absurd branding would capture $500 million in less than a day.”

Either way, the coming days will prove critical for the future of YAM.

YAMv2 daily chart with volume. (Source: coingecko.com)